The end of Q4 also marks the end of a tumultuous year for the Dutch housing and mortgage market. High inflation, feeding into rising interest rates, and increased economic uncertainty had a significant effect on the housing and mortgage market. Nevertheless, 190 thousand home sales were registered and more than 150 billion euros in new mortgages were originated in 2022.

Although it is difficult to forecast exactly what 2023 will bring, we expect high mortgage rates to persist. The higher rates continue to have an impact on affordability which in turn affects borrowing capacity and hence house prices. Rising household income and persisting housing shortage will however absorb some of the downward pressure. In terms of new mortgage origination, the market is expected to be significantly smaller than in 2022, which is largely due to the departure of refinancers.

Main developments

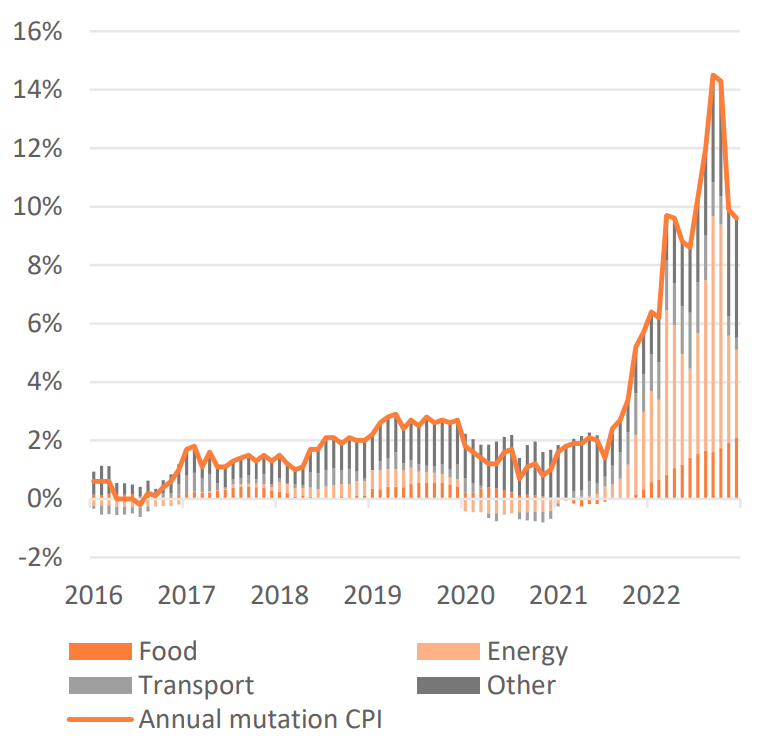

Whereas energy prices initially fuelled inflationary pressure, they fell by the end of 2022. However, as the higher price of energy seeped through to commodity and food prices, the purchasing power of households is likely to remain under pressure. In particular, as the rise of commodity and food prices are stickier than the cost of energy.

As inflation remains well above the inflation target of 2%, the European Central Bank (ECB) is likely to maintain its tight monetary policy in its attempt to slow down the economy and control inflation.

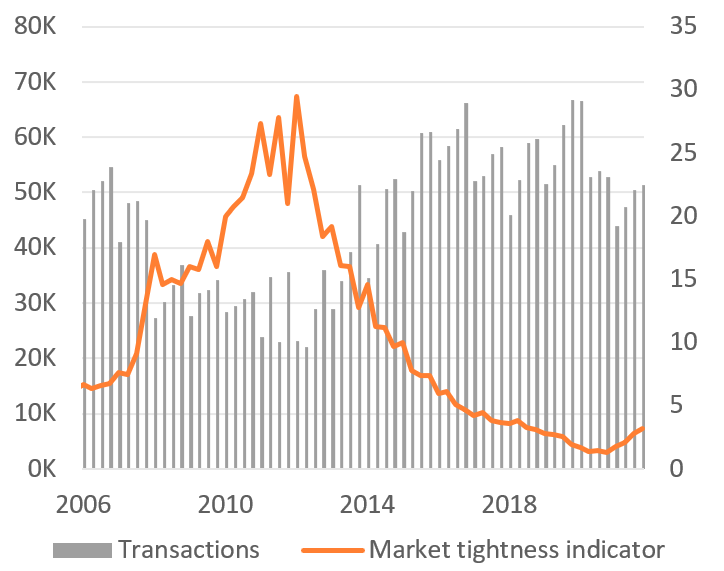

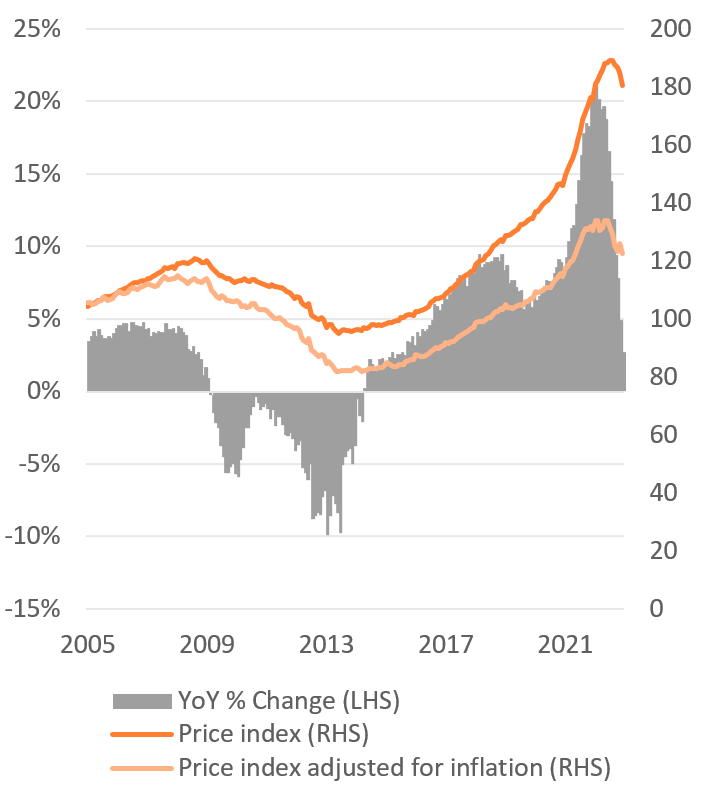

Economic uncertainty and higher interest rates continue to affect the Dutch housing market. Sellers are more concerned with the timing of their sale while buyers are becoming more cautious, causing fewer viewings, fewer bids and a decline in the number and amount of overbids. As a consequence, the number of transactions fell, while the number of houses for sale grew, thereby pushing down house prices. Despite the deteriorated dynamics in supply and demand, the housing market performed very well with more than 190,000 transactions in 2022.

Refinancers caused a peak in mortgage applications at the beginning of the year but with increasing mortgage rates the incentive to refinance disappeared, leading to a full withdrawal of refinancers from the market. At the same time, existing borrowers decided to start using their mover option, which allows porting their current mortgage conditions to a new house. As a result, mortgage clients are inclined to stay with their current mortgage provider and will not enter the market at all.

Despite the gradual decline in applications due to the disappearance of refinancers, there were still more than 520 thousand registered mortgage applications in 2022, enabling the mortgage market to reach a total volume of over 154 billion euros, which is very high from a historical perspective.

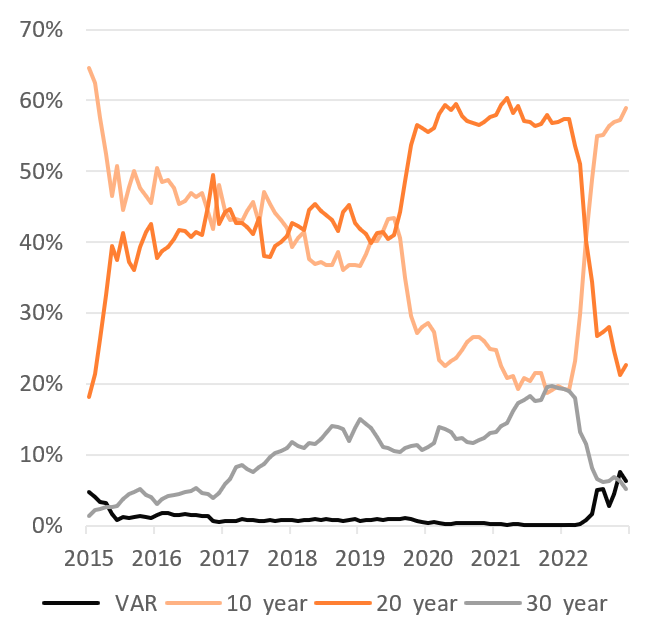

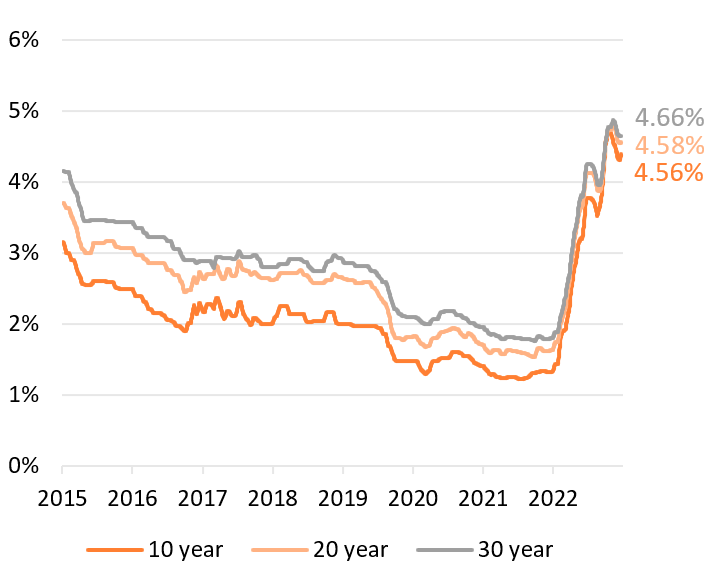

The increased interest rates also resulted in a shift in consumer preference from longer- to shorter fixed-interest periods. The magnitude of this shift is particularly visible when comparing the situation to 2021 when almost 80% of the mortgage applications had a fixed rate period of 20 years or longer. The situation at the end of 2022 is markedly different, as the share of mortgage applications with a fixed rate period of 20 years or longer has declined to 30% while the market share of 10 years or shorter increased to 70%.

So far, the weakened financial situation of households has not translated into payment problems for existing mortgage borrowers. This can be explained by the conservative Dutch lending standards, ensuring an adequate income buffer for households to cover unexpected shortfalls or extra costs. In addition to these standards, the Dutch labour market remains very tight, thereby providing financial security for households.

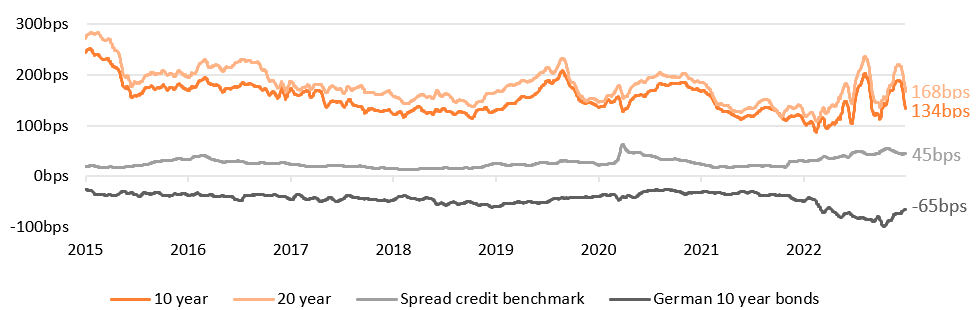

In line with the turmoil in the financial markets, spreads on Dutch mortgages were highly volatile. Despite that, Dutch mortgages remained an attractive asset class given the continued strong credit performance and the relatively high spreads compared to other long-term fixed-rate assets.

Outlook for 2023

2023 commenced with reports of declining inflationary pressures as energy prices continued to fall in January. Nevertheless, commodity and food prices increased as the higher energy costs already seeped through production costs in several sectors.

As financial market unrest reflects, it is hard to predict future inflation and interest rate developments. We therefore can only assume a continuation of the current market circumstances, with high mortgage rates, as a basic starting point for our outlook.

Economics

The outlook for the Dutch economy will be shaped by further implications of inflation on the general price level and hence consumer spending. Since energy prices are declining and the Dutch government implemented a comprehensive support package, the impact of energy prices is expected to be limited. However, as energy prices already seeped through commodity and food prices, it is assumed that these secondary effects will be dominant for the economic conditions in 2023.

In line with inflationary pressures, the ECB will determine whether it should continue to intervene by raising its key policy rates, and when it has achieved the desired interest rate in order to slow down the economy, thereby reducing inflation. A concern would be that raising the key policy rates, could potentially result in a decline in economic activity and hence a large increase in unemployment.

Housing market

The housing market is strongly affected by financial conditions and mortgage affordability. In addition, the market sentiment, how potential buyers perceive the market, also plays an important role.

As long as there is uncertainty, buyers will remain cautious, while sellers will focus on the best time for their sale. A decrease in demand could lead to a further reduction in the number of housing transactions and eventually have a negative impact on house prices.

In a situation where house prices continue to fall, the housing market potentially becomes more accessible to households with fewer financial resources, such as first-time buyers. Nevertheless, the severe housing shortage remains a major complication for the market. Especially in combination with rising household income, it is expected that both factors absorb some of the downward pressure in housing prices.

Mortgage market

The mortgage market has changed fundamentally over the past year and is not expected to revert as long as mortgage rates remain at the level as they currently are. Therefore, we expect that the attractiveness of shorter fixed-interest periods will prevail over longer fixed-interest periods in 2023 and the market share of refinancers (primarily lower LTV buckets) will remain limited. Borrowers are expected to make more use of the mover option and continue the mortgage with their current lender. As a result of that, a part of the market will remain unavailable to other lenders.

With high mortgage rates, the households' maximum borrowing capacity will be limited, which is expected to result in a continuation of the current lower number of mortgage applications and subsequently in mortgage volume.

Dutch residential mortgages

As the Dutch lending standards are generally conservative both existing and new borrowers are expected to be able to cover unexpected shortfalls or extra costs. Therefore, Dutch mortgages are expected to perform well, with correspondingly low levels of arrears and losses.

Although we cannot predict future interest rate developments, based on historical trends we expect that the spread on Dutch mortgages value will remain relatively attractive compared to other assets with a comparable risk profile such as government bonds and credits.

Economic indicators

Since energy prices have fallen, higher commodity and food prices have become the most dominant factors affecting households’ purchasing power. The Dutch economy should be able to absorb these developments as it has a tight labor market, accumulated household savings and an extensive support package from the Dutch government.

Economics

After a mild and temporary economic slowdown in Q3 2022, the Dutch economy grew by 0.6% QoQ and 3% YoY in Q4 2022 according to the Dutch Central Bureau of Statistics (CBS). The growth in Q4 was mainly attributed to continued spending from consumers on services and an increased volume of the export and imports of goods and services.

Over the course of 2022, GDP grew by 4.5% YoY, however, we should take into account that during 2021, the Dutch economy faced several restrictions due to COVID-19.

In December, the Governing Council of the ECB decided to raise its key policy rates by 50 basis points for the fourth time this year. The ECB stated that, based on the substantial upward revision of the inflation outlook, interest rates will still have to rise but at a steady pace during 2023. This is to ensure interest levels are sufficiently restrictive for a timely return of inflation to the 2% target.

Inflation

Inflation has been well above acceptable levels for some time and is expected to remain so for the foreseeable future. Whereas initially, energy prices were the most decisive driver of inflation, commodity and food prices have recently become increasingly relevant in consumers' daily lives. In particular, the underlying ‘core inflation, excluding energy and food prices’ has been rising steadily recently.

With the drop in energy prices, inflation decreased from 14.5% in September (including 2.8% for electricity and 5.2% for gas) to 9.6% in December (including 1.2% for electricity and 1.8% for gas). While this trend seems positive, it is important to realise that across the economy underlying price pressures, often as a result of higher energy prices, have strengthened and will persist for some time. This is particularly the

case for the production of food and commodities, as high manufacturing costs are passed through to consumer prices.

The high level of inflation will persist throughout 2023. On one hand, inflation is being depressed by the price ceiling introduced by the Dutch government. The ceiling sets a maximum price for energy consumption. As a result, only a (small) portion of energy consumption is exposed to market prices. On the other, the broadening of inflation continues as companies will pass on the increased energy costs to consumers since many have fixed energy contracts and have not yet had to absorb the full energy price increase. In addition, companies are also expected to pass on increased labour costs.

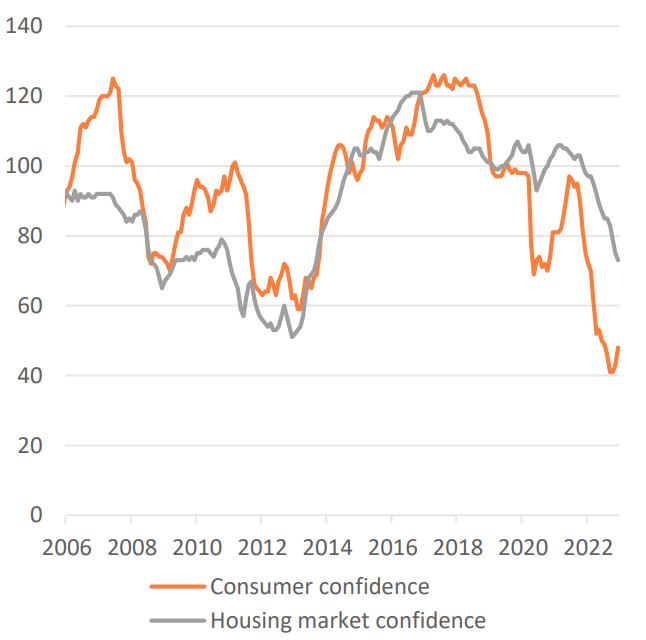

Sentiment indicators

After reaching an all-time low of 41 at the end of Q3 2022, consumer confidence [1] improved to 48 in Q4 2022.

The improved consumer confidence is mainly driven by less pessimism about the economic outlook and the financial situation of households for the next 12 months. Although confidence has improved in recent months, the indicator is still at a historically low level.

Despite the lack of confidence throughout the year, consumers maintained a high level of consumption. This can be attributed to accumulated savings during COVID-19, which allowed a strong recovery of spending after the lockdown. The catch-up effect, however, is beginning to diminish as the effect of inflation on consumption becomes more visible, potentially leading to a contraction of consumption.

Confidence in the housing market [1] fell to 73 at the end of 2022. The negativism about the housing market is still primarily driven by higher mortgage rates (reducing the borrowing capacity), house price trends and general economic conditions. The negative sentiment also affects the market, as people could anticipate to future price declines and therefore postpone their purchases.

Labour market

With an overall unemployment rate of only 3.6% in Q4 2022, the labour market provides some protection against the loss of purchasing power of households due to inflation. The perceived financial assurance does not only stem from wage retention, but also from wage increases during 2022.

Collective wages grew by 3.7% QoQ in Q4 2022 and 3.2% YoY in 2022, which are the largest increases since 2000 and well above historical averages. In addition to wage increases, many companies offered their employees additional (financial) support.

Furthermore, in 2023 the minimum wage and the associated state pension will rise by 10% too.