Return profile

Dutch mortgage loans have historically performed very well relative to asset classes such as investment grade credit or government bonds. Depending on the exact duration and risk profile, mortgage spreads have ranged within a bandwidth of 100-250 bps over the past decade.

The spreads on Dutch mortgages are strongly correlated to interest rates (±0.8 correlation with the EUR swap curve), as most mortgage lenders tend to base their mortgage rates on the prevailing swap rates.

Pricing tends to respond more slowly to capital market movements, making the price volatility of mortgages relatively low. This is similar to other private credit assets.

Mortgages are suitable to match longer-term liabilities and thus a valuable contribution to a traditional liability-driven investment (LDI) portfolio.

These fundamentals have contributed to extremely low arrears and credit losses on Dutch mortgages compared to other European markets.

Low credit risk investment

The Netherlands has one of the strongest economies in the world and benefits from important fundamentals such as a well performing labour market, a solid social security system (including unemployment coverage) and political stability.

These fundamentals have contributed to extremely low arrears and credit losses on Dutch mortgages compared to other European markets.

The arrears and low losses are not just the result of economic prosperity. They also stem from the strong payment morale of Dutch borrowers, as well as a creditor-friendly legal system. The latter allows for a quick selling process of the property in the rare case enforcement would be necessary.

The legal and regulatory environment also prevents excessive lending as mortgage originators need to adhere to LtV limits and mandatory affordability tests. LtVs are capped at 100%, however, for certain energy-saving improvements exemptions are allowed.

The income-based borrowing capacity of households is measured by affordability tests, taking into account household expenditures, as well as tax aspects of mortgage loans. The affordability standards are determined by the independent National Institute for Family Finance Information, set by the Dutch government and apply to all owner-occupied Dutch mortgage loans. The Dutch lending standards are generally seen as conservative and contain sufficient room for borrowers to cover unexpected shortfalls or extra costs.

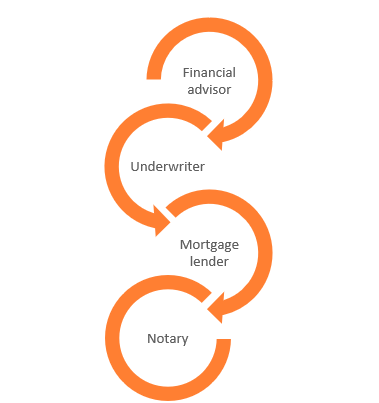

Financial advisors and mortgage lenders are also obliged to consult the National Credit Registration Office, where the debts of all Dutch households are registered. This register covers mortgage loans as well as other types of loans, such as consumer loans and credit card debt.

Dutch housing market

The Dutch housing stock consists of more than 8 million properties. 57% of those are owneroccupied and the remaining 43% are rental homes. This distribution has remained stable over the past decade. The relatively high share of rental houses is the result of a dominant social housing sector: 29% of all Dutch houses are owned by a social housing corporation. While social housing is primarily intended for lower income households, owner-occupied properties are mainly held by middle and higher income households.

Historically the Dutch government has encouraged home ownership through a mortgage guarantee scheme (NHG). This NHG guarantee applies to mortgages up to a certain amount (EUR 405,000 in 2023) and mainly supports lower and middle income households. The NHG guarantee covers 90% of the losses in the case of foreclosure. The remaining 10% is borne by the lender.

The Dutch government also stimulates home ownership via the Dutch tax system. Mortgage interest payments on owner-occupied properties can be deducted from the borrower’s taxable income in the lower income tax band. This only applies if a mortgage is repaid in full over 30 years on an annuity basis.

The Dutch housing market is facing a significant housing shortage. This is the result limited land availability for housing and the lack of building permits due to, among others, environmental limitations. In 2022, the Dutch government set a target to increase the number of new build properties to 100,000 per year, adding up to 900,000 by 2030.

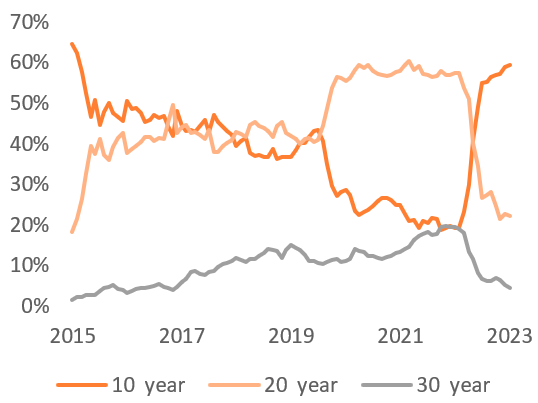

The housing shortage and low interest rates caused house prices to steadily rise after the global financial crisis. By mid 2022, the house price growth flattened due to rising interest rates and the corresponding impact on mortgage affordability.

For 2023, most economists expect a further softening of the housing market. This might increase the number of purchasing options available for prospective buyers (especially first-time buyers).

The significant housing shortage will nevertheless continue to be a dominant driver for demand.

Dutch mortgage characteristics

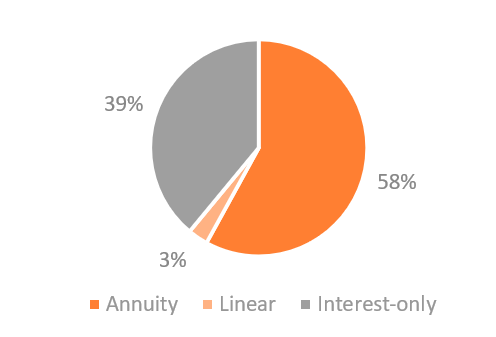

Underwriting criteria are strictly regulated in the Netherlands and lending is highly standardised. This ensures mortgage affordability but also limits the number of mortgage product types. In general, three repayment types of mortgage loans can be distinguished:

- Annuity mortgage loans in which the borrower makes monthly payments for the (gradually diminishing) interest and the repayment;

- Linear mortgage loans in which the borrower pays a fixed monthly amount covering both interest and repayment; and

- Interest-only mortgage loans.

With a maximum of 100% loan-to-value (LtV), the Dutch mortgage market offers a relatively high advance rate against a property. The risk of excessive lending is, however, minimised by affordability tests, robust valuation standards and compulsory repayments.

Borrowers may also use standard mortgage loans for renovations, home improvements, purchasing a new build off-plan and even building their own home. In all these cases, the amount of the loan that is needed for building works will be held in a construction deposit. Borrowers can draw from these construction deposits during the building process. This mechanism is also increasingly used to implement energy-saving measures such as insulation, high-efficiency glazing and solar panels.